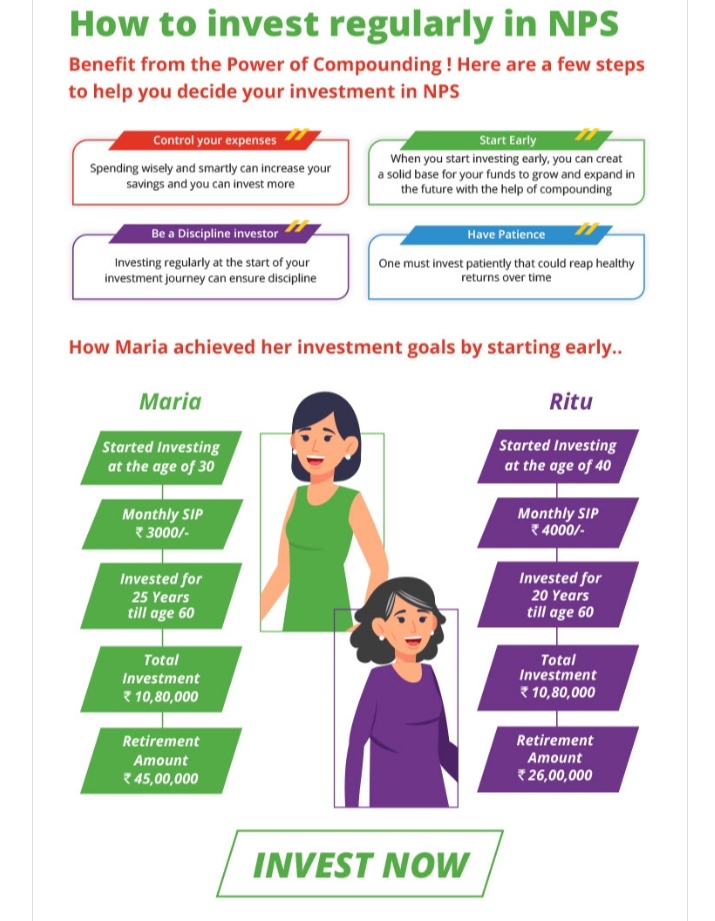

What are the tax benefits under NPS Schemes? How to invest regularly in NPS?

What are the tax benefits under NPS Schemes?

Tax Benefit available to Individual:

Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE.

Exclusive Tax Benefit to all NPS Subscribers u/s 80CCD (1B)

An additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1B). This is over and above the deduction of Rs. 1.5 lakh available under section 80C of Income Tax Act. 1961.

Tax Benefits under the Corporate Sector:

Corporate Subscriber:

Additional Tax Benefit is available to Subscribers under Corporate Sector, u/s 80CCD (2) of Income Tax Act. Employer’s NPS contribution (for the benefit of employee) up to 10% of salary (Basic + DA), is deductible from taxable income, without any monetary limit.

Corporates

Employer’s Contribution towards NPS up to 10% of salary (Basic + DA) can be deducted as ‘Business Expense’ from their Profit & Loss Account.

How to make the Investment to avail the Tax Benefit:

If you are an existing Subscriber, you can approach any POP-SP or alternatively you can visit eNPS website (https://enps.nsdl.com) for making additional contribution in your Tier I account.

Please note: Tax benefits are applicable for investments in Tier I account only.

Apart from tax benefits available under 80CCD, below are the other tax benefits available under NPS:

Tax benefits on partial withdrawal:

Subscriber can partially withdraw from NPS tier I account before the age of 60 for specified purposes. According to Budget 2017, amount withdrawn up to 25 per cent of Subscriber contribution is exempt from tax.

Tax benefit on Annuity purchase:

Amount invested in purchase of Annuity, is fully exempt from tax. However, annuity income that you receive in the subsequent years will be subject to income tax.

Tax benefit on lump sum withdrawal:

After Subscriber attain the age of 60, up to 40 percent of the total corpus withdrawn in lump sum is exempt from tax.

For example: If total corpus at the age of 60 is 10 lakhs, then 40% of the total corpus ie 4 lakhs, you can withdraw without paying any tax. So, if you use 40% of NPS corpus for lump sum withdrawal and remaining 60% for annuity purchase at the time of retirement, you do not pay any tax at that time. Only the annuity income that you receive in the subsequent years will be subject to income tax.

What are the benefits of Tier II NPS Account ?

There is no tax benefit on investment towards Tier II NPS Account.

INDIANNAVYPARTICIPATESINBILATERALNAVALMARITIMEPARTNERSHIPEXERCISEWITHUAENAVYQ0L1.jpeg)